Gold coins and bullion bars – safely delivered or securely stored

BFI Bullion is a precious metals company from Switzerland that offer a safe and convenient way of buying and selling gold, silver, platinum and palladium. All metals can be safely delivered or securely stored in high-security vaults of your choice in Switzerland, Singapore, Hong Kong, and New Zealand.

Gold can be bought as bullion coins or gold bars, ranging from one ounce to one kilogram. As a BFI Bullion client, you can buy and sell bullion coins and bars at superior rates, avoiding the brokerage commissions and high margins associated with gold retailers.

You can have your metals delivered, or pick them up personally. There is also the option of transferring gold you already own into BFI Bullion’s storage facility (pending quality controls).

BFI Bullion is open for clients with an initial minimum investment of CHF 50,000 (or equivalent in USD/EUR/GBP).

Contact BFI Bullion.

Gold storage in Switzerland

BFI Bullion was founded in 2007 (previously known as Global Gold) at a time when there were growing concerns over the global financial system. They provide physical storage of gold in Switzerland – 100% owned by the investor (no fractional ownership) and not held with a bank or in a fund.

This is an important distinction because in the unlikely event of BFI Bullion going bankrupt the creditors cannot claim your metal. As the gold is owned by you it can’t be hedged or borrowed against by BFI Bullion.

All gold bought through BFI Bullion is 100% allocated, so for every ounce that is bought there is a corresponding ounce in storage. Some online gold traders offer unallocated gold, making the gold account holders unsecured creditors.

In addition to Swiss gold storage, gold can also be stored in Hong Kong, Singapore, and New Zealand

Buy Gold Products

BFI Bullion sell gold coins and bullion bars at highly competitive rates. Gold is sourced directly from reputable wholesalers and from refineries in Switzerland approved by the London Bullion Market Association (LBMA).

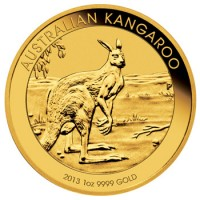

Bullion Coins

The selection of gold bullion coins include the world’s most famous one-ounce coins from government mints. These coins not only hold numismatic value, but they are also easily sold as they are always sought after. Each coin holds one ounce of pure gold. In the case of the 22 karat coins (fineness of .9167), the gross weight is 1.0909 troy oz.

|

Australian Gold Nugget  Perth Mint (Australia) Weight: 1 ounce Fineness: .9999 |

Britannia  Royal Mint (UK) Weight: 1 ounce Fineness: .9999 |

Gold Maple Leaf  Royal Canadian Mint Weight: 1 ounce Fineness: .9999 |

||

|

Vienna Philharmonic  Austrian Mint Weight: 1 ounce Fineness: .9999 |

American Gold Eagle  United States Mint Weight: 1 ounce Fineness: .9167 |

Krugerrand  South African Mint Weight: 1 ounce Fineness: .9167 |

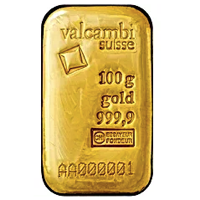

Gold Bars

Gold bullion bars range from one ounce to one kilogram of .9999 gold. Gold bars are refined in Switzerland, and suppliers include Argor-Hereaus and Valcambi.

|

1oz Gold Bar  Weight: 1 ounce Fineness: 999.9 |

100g Gold Bar  Weight: 100 gram Fineness: 999.9 |

250g Gold Bar  Weight: 250 gram Fineness: 999.9 |

||

|

500g Gold Bar  Weight: 500 gram Fineness: 999.9 |

1kg Gold Bar  Weight: 1 kilogram Fineness: 999.9 |

Gold Storage

High-security storage is available in Switzerland, Hong Kong, Singapore, and New Zealand. There are different options available depending on your holding size and personal preferences.

Collective Storage

Collective Storage (COL) offers the most cost-effective way to store gold. The gold coins and bars you own are physically stored with the holdings of other BFI Bullion clients in a high-security collective storage vault. This is the cheapest and most popular option.

Collective Storage (COL) offers the most cost-effective way to store gold. The gold coins and bars you own are physically stored with the holdings of other BFI Bullion clients in a high-security collective storage vault. This is the cheapest and most popular option.

BFI Bullion maintains a 100% physical backing of clients’ gold in the same format.

The minimum value is CHF 50,000, with storage fees ranging from 0.70% to 0.40%.

Segregated Storage

Segregated Storage (SEG) offers high-security storage of your gold in a physically separate space within the BFI Bullion vault area.

Segregated Storage (SEG) offers high-security storage of your gold in a physically separate space within the BFI Bullion vault area.

This can be a box, or shelves and palettes if it’s a larger volume. It may be possible to store gold outside of the standard product offering, pending approval.

Clients are allocated a numbered box or storage shelf and serial numbers for your bars, which are shown on your storage report. This option is best if you need to know the specific bar numbers of your bullion, or if you wish to store gold has has important individual value such as historical bars or family heirlooms.

For this option a minimum value of at least CHF 250,000 is required, with storage fees ranging from 0.70% to 0.35%.

Key Box Storage

Key Box Storage (KBS) provides high-security storage of your bullion bars or numismatic coins in a locked container, which can only be opened by the client or their representative. The declared content of the key box is fully insured, and this service is only available in Switzerland.

Key Box Storage (KBS) provides high-security storage of your bullion bars or numismatic coins in a locked container, which can only be opened by the client or their representative. The declared content of the key box is fully insured, and this service is only available in Switzerland.

A minimum value of at least CHF 250,000 in stored metals is required. To open a Key Box account costs CHF 450 for a new lock and two keys, and there is an administration fee of CHF 500.

A single box can store up to 30 Kg of gold, and for insurance purposes, the client sets the value of the numismatic collection. The insured value sets the rate of the annual storage fees.

Storage Fees

Storage fees are paid annually at the beginning of each year for the prior fiscal year. Payment can be made online via credit card or by bank-to-bank wire transfer. The fee is calculated on the average spot price of the storage period (January 1st to December 31st, or pro-rated if not a full year).

The storage fees include insurance, so your gold is fully insured against fire, water, fraud, theft and burglary.

Delivery and pick-up of gold

Your gold can be delivered to you at any time, and as the gold is already in stock there are no delays in delivery preparation. The delivery cost is additional to the purchase price of the gold (paid by the owner), and the gold is fully insured during delivery.

BFI Bullion ships gold internationally. There are shipping rules and restrictions for different countries, so confirm before buying to get a detailed quote.

It’s also possible to pick up your gold directly from the storage facilities or the BFI Bullion office. Allow for a one or two day lead time to arrange the pick-up.

How to buy gold at BFI Bullion

To buy and sell gold online, apply at BFI Bullion. There are generally no restrictions on citizenship, though you will of course need to pass due diligence in compliance with Swiss law. A US person is required to report BFI Bullion holdings and should consult with a United States tax expert if they are unfamiliar with investing abroad.

Account types can be private, individual clients, or legal entities such as a trust or company.

Once your account is approved you can start trading immediately. Gold bought online can be delivered to you or stored in your preferred location and storage method.

BFI Bullion generally requires a minimum initial investment of CHF 50,000 (or equivalent in USD, EUR, or GBP). Subsequent purchases can be done for a minimum CHF 20,000, or based on the minimum lot size of each metal format.

Open an account by registering to become a BFI Bullion client.

About BFI Bullion AG

BFI Bullion AG is a subsidiary of BFI Capital Group, a wealth management firm located in Zug, Switzerland. BFI Bullion is a 100% Swiss company, and operates in accordance with Swiss law and regulations.

BFI Bullion AG is a subsidiary of BFI Capital Group, a wealth management firm located in Zug, Switzerland. BFI Bullion is a 100% Swiss company, and operates in accordance with Swiss law and regulations.

BFI Bullion AG was incorporated in Switzerland in 2007 as Global Gold AG. In 2021 the company rebranded from Global Gold to BFI Bullion. Scott Schamber, the Managing Director of BFI Bullion, explains the reasons behind the name change in this video.

As a registered member of VQF (Financial Services Standards Association), BFI Bullion is regulated and audited by FINMA, the Swiss Financial Market Supervisory Authority.

BFI Bullion is headquartered in Engelberg, Switzerland. The address for their Advisory Center is Zürichstrasse 103e, 8123 Ebmatingen, Switzerland.

View on Google Maps.

Follow Us